BY. ECONOMYNEXT

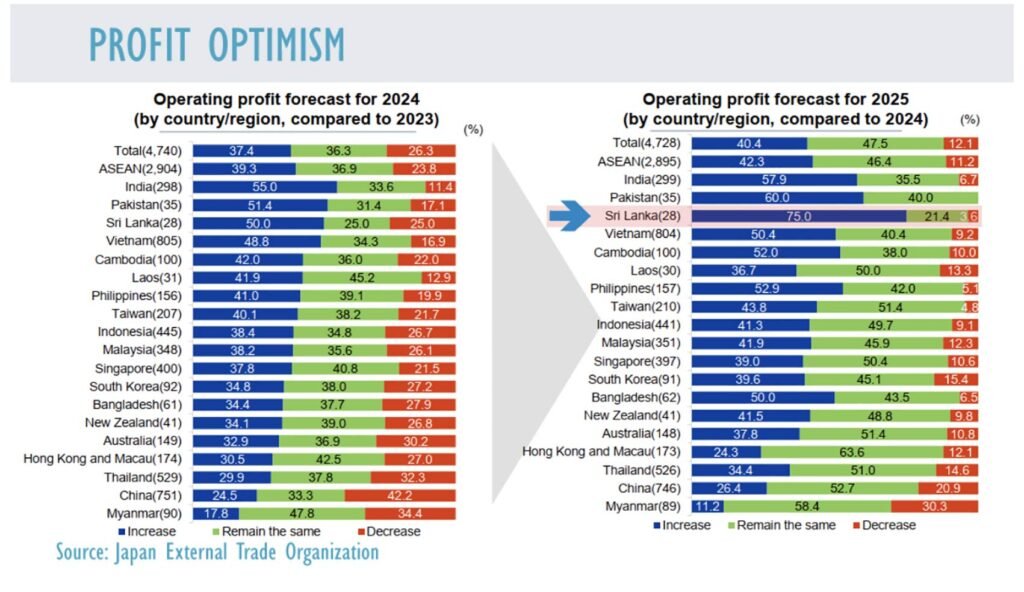

About 75 percent of Japanese firms in Sri Lanka expected profits to grow in 2025, the highest

share of confidence in any country in the Asia-Oceania region, a survey by the Japan External

Trade Organization has shown.

About 21.4 percent of firms expected operating profits to remain the same and only 3.6

percent to decrease.

The 75 percent positive expectation in Sri Lanka for operating was higher than India’s 57.4

percent, Philippines’ 52.9 percent, Vietnam 50.4 percent and Bangladesh 50 percent.

India is currently having monetary troubles, with the Reserve Bank of India cutting rates,

despite the exchange rate coming under and pressure and has got embroiled in a cycle of

sterilized interventions.

Bangladesh is recovering from a currency collapse.

In Sri Lanka the central bank operated exceptional deflationary policy, pricing prices rising

marginally since September 2022, levels seen in countries like Germany before the ECB and

Singapore in the past, laying a strong foundation for growth.

However, the central bank triggered some instability in the last quarter by printing money for

a ‘single policy rate’ (a de facto floor rate and abundance reserve regime) and analysts have

urged the agency not to push up excess liquidity in money markets to artificially suppress

rates.

Related Sri Lanka Central Bank ‘exceptionally great’ in achieving deflation: Legislator

“Reasons for the improvement included ‘increase of demand in the local market’,

‘strengthening the sales system in the local market’, ‘improvement in production efficiency’,

as well as ‘lifting of vehicle import ban’ and ‘reduction in container freight rates’,” JETRO

said in a statement.

“Japanese companies in Sri Lanka are also positive about their future business

In the next 1-2 years 36.7 percent (+ 8.6 percent from 2023) said they planned ‘expansion’.

They pointed to ‘expansion of their local sales network’ and ‘development of new products’.

However, 13.3 percent (+ 7.0 percent from 2023) answered ‘reduction’ or ‘transferring to a

third country /region or withdrawal’.

Low labour costs, and fewer linguistic / communication problems, were among the top

reasons for investing in Sri Lanka.

The negative reasons were ‘political or social instability, followed by unclear government

policy management’ and currency volatility’.

Sri Lanka has high levels of inflation (rising cost of living) and exchange rate depreciation,

leading to social unrest as well as ad hoc government interventions as a result.